Digital Marketing for

Independent Insurance Agencies

Convirtue specializes in helping independent insurance agencies grow through scalable digital marketing solutions.

Get Started

Start a conversation with an insurance marketing specialist today. Tell us your unique goals and we can discuss if Convirtue is a good fit.

We will get back to you as soon as possible

Please try again later

Rather call us?

720-772-1912

How to Market Your Independent

Insurance Agency in 2023-2024?

Every successful independent insurance agency (IIA) needs great marketing to grow. When your profits depend on a steady flow of new leads, finding effective ways to attract potential customers matters all the more.

As an insurance agency principal, there are many marketing opportunities available to you online. Though, it's quite difficult to come across marketing tactics in the insurance industry that actually work. But with the right digital marketing strategy, you can reach your target audience, convert more leads, and outperform your competitors.

We're going to provide you with our exact strategy we use for the insurance industry that generates consistent high-quality leads on a monthly basis.

The Ultimate Guide to Marketing

Your Insurance Agency

Here is the most comprehensive guide and marketing ideas to help your insurance agency grow online in 2022 and generate more potential leads on a consistent basis!

1. Conversion-Driven, Mobile-Optimized Website

Having a fully-optimized, mobile device responsive website is arguably the most important marketing tool that will not only boost your credibility and give your insurance business a more professional image, it can result in online insurance leads.

But what defines a fully-optimized, conversion-driven website, and how do you know if you have one? A good question to start with is, how much did you pay for your website? Though price is not the tell-all when it comes to understanding if your website is optimized, its a strong indicator.

There are a lot of online marketing services in the land of insurance that offer websites for as low as $299-$599/mo.

These are typically cookie cutter template websites, with duplicated content, that are distributed to over 100+ agencies nationwide. These types of websites allow you to have an online presence, but are not optimized to your specific agency's goals. Additionally because they contain duplicate content, which essentially is copied content and redistribute to other websites, they will not rank in top listings on Google.

So how do you create a fully-optimized website, and how much does it cost? When we're designing a website for one of our insurance clients, the first thing we need to discuss is their business goals. From there, we incorporate over 1000+ data points and best practices into the website design. These are measured and based on 4 stages of the customer digital journey:

- Awareness Creation - defined as attracting and generating quality traffic and leads to your website.

- (E.g. SEO, Social Media Management, Paid Ads, Directory Management etc.)

- Demand Generation - once the website visitor lands on your website what is keeping them on site or learning more about your business and offerings

- (E.g. Customer Reviews, In-depth, content rich product or industry pages, your agency's unique story, images of your team and office)

- Conversion Optimization - once the website visitor is compelled to work with your agency, how easy is it for them to get a quote or contact an agent

- (E.g. Strong, always visible CTA button, short and concise quote forms, online chat feature, click-to-call CTA buttons)

- Customer Experience - as a current client or an ideal customer, can the visitor effectively pay their bills on the website, learn more about additional offerings, understand saving by bundling?)

- (E.g. Prominent client portal section, automated emails when policies are expiring)

And the cost? This varies depending on the overall project, but we typically see from an experienced agency rates going for anywhere between $2000 - $10,000.

It's important to note that having an optimized website design is paramount, it should be treated as a set and down strategy. To effectively dominate online, you need to constantly update and publish new content on your website to succeed, which leads into the next section, local SEO.

2. Use Local SEO

Quite simply, it is one of the best and most cost effective marketing strategies for independent insurance agencies. Insurance agencies can generate more sign-ups, meetings, and revenue by taking advantage of organic search.

When prospective customers are in the market for insurance products, their search almost always begins online, specifically Google. Your services could be exactly what these leads are looking for — but if your business is not ranking within the first 5 results on Google, you're almost never be found.

So you may be asking yourself how can I start ranking page 1 on Google, and what exactly are search engines looking for? We got you covered.

When a search engine’s bots crawl the web, they’re looking for more than just keywords. SEO algorithms are built around three main pillars (ART):

- Authority

- Relevance

- Trust

These metrics are measured by a range of factors — like content quality, link building, and social media sharing. But these impacts strengthen over time, and there’s no easy shortcut to accelerate the process. However, you can design your IIA website to get a competitive advantage. Build your website’s authority, relevance, and trust by delivering what search engines want to see.

But what do they want?

There are several things you can do to optimize your website for search engines:

Keyword research: This is the first step to crafting a strategy for SEO. Keywords are a very important part of SEO because Google and other search engines use them to figure out what your site it about, and if it’s appropriate to deliver it in search results based on the search query.

You can use a service like SEMRush, Ahrefs, or Uber Suggest to find keywords within your industry. Another hack for find keywords and keeping a log of frequently asked questions by your leads and customers. If they're asking you that question, they probably couldn't find it on Google.

Title and meta tags: These are another great action item to optimize your website. Once you have decided which terms and phrases you’re going to target based on your keyword research, you’ll want to use those terms in the H1 Tags, title tags and meta descriptions of the appropriate pages on your website.

Content: The content on your website is very important. It should never be over looked or minimized. That’s not to say that you want to repeat yourself over and over again, or even that you want 3,000 words of fluff that doesn’t make sense.

The point of content is to have both quality and quantity. Use your copy to educate your visitors, answer their questions, and provide them with enough information to establish yourself as a reliable source and expert in the industry. Insert the keywords you previously determined to target naturally within the copy so search engines can figure out what your page and site are about.

Internal linking: This is when you link one page on your site to another page on the site via a term or phrase within the content of the page. This strategy helps communicate to Google the pages that are important on your site.

Link building: Building links is another important part of SEO, but one that should be done carefully. Links are great… most of the time. If another site links to your website, it typically sends a good signal to search engines, and that’s because it means that other website trusts you enough to send their traffic to your site. Links aren’t good when they aren’t natural, however. It’s okay to contact a blogger and provide them with the address of your website if you notice that they mentioned you or your insurance company, but it’s not okay to buy links.

3. Write long-form content

Long-form content is an in-depth piece of content about a topic that others are looking for more information on.

The purpose of long-form content is to provide users with answers to their questions, a resource for people to share, and to continue to establish yourself as an expert in your industry that can be trusted, not just another insurance provider.

Ideally shoot for a blog or content page with over 2000-8000 words with images, videos, and infographics.

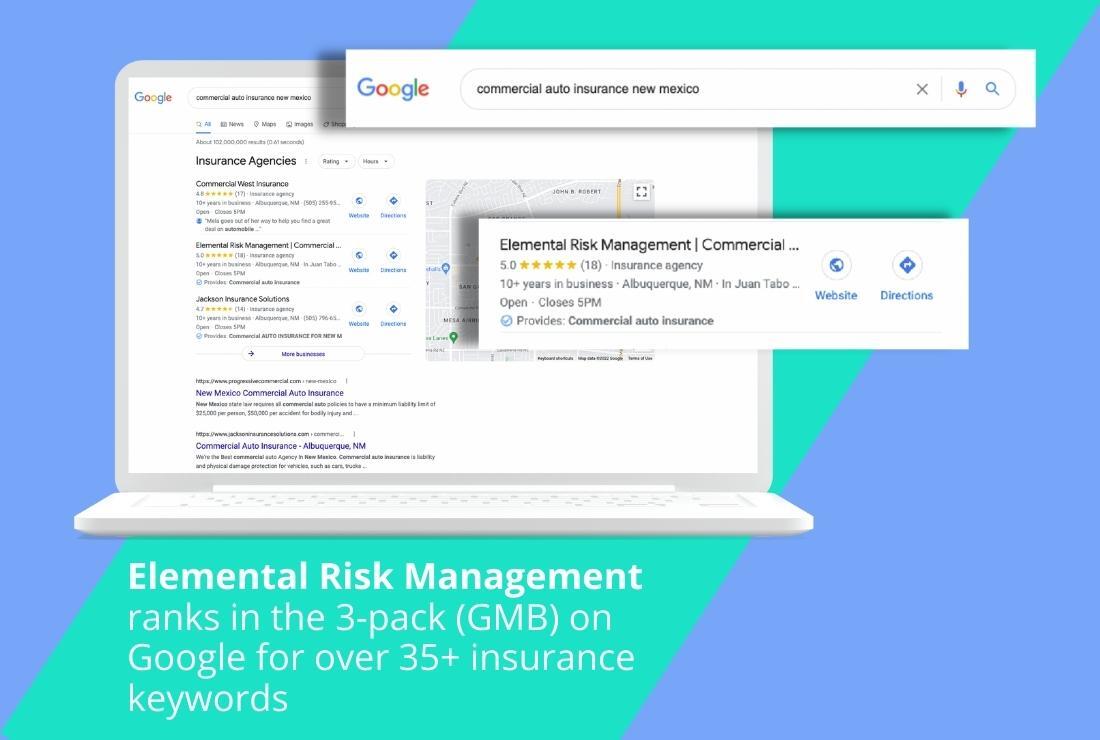

4. Google My Business

Google My Business (GMB) is a free tool that allows a business owner to manage how their company appears on Google applications such as Google Search and Google Maps. When searching on Google for a specific business, you might have noticed the profile that pops up on the right side of the screen.

For example, if you type the name of your favorite restaurant into Google and they have Google My Business set up, you will be able to see a description, address, hours, menu, phone number, and reviews from different platforms.

When used correctly, GMB offers a fantastic opportunity to engage with your clients. As an IIA, client engagement is a great way to create a positive reputation for your brand and attract potential leads. But how can you incorporate GMB into your agency's marketing strategy.

Here's our comprehensive guide to set up a Google My Business account.

5. Positive Online Reviews

It’s a well-established fact that over 84% of consumers trust Google reviews as much word of mouth referrals from friends or family members.

Insurance agents and insurance providers need consistent and positive reviews in order to provide objective testimonials to prospective clients.

By curating positive online reviews, insurance agents can establish trust and build a reputation for good service that will help develop trust with prospects.

Here are a few tips to start generating review:

- Make it a daily business practice to ask every customer if they were satisfied with the customer service they received.

- Respond to positive reviews and thank them. People will be more likely to leave reviews when they see that their gratitude is being acknowledged.

- When a new customer takes out a policy and is happy about saving money from switching companies, ask them to tell their friends about you and leave a review on your social media account.

- After a claim has been settled favorably for a customer, follow up to see if they need anything else, and if they are satisfied with how things were handled, ask for a review

- Send hand-written thank you cards to customers who leave positive reviews. They may send more referrals your way.

- Setup your own review or testimonial section on your website to highlight happy customers.

6. Social Media Marketing

LinkedIn, Facebook, and Twitter are all great social channels for insurance companies. Social media marketing is essentially digital networking and has very similar rules:

- Be active and engage with others

- Listen more than you talk

- Give to receive

- Be genuine and respectful

To be top of mind, you need to stay consistent across these channels!

GET STARTED TODAY

Turn your SMB's website into a powerhouse channel for driving revenue. Book a free 30-minute marketing assessment with one of our digital experts today!